Norman C. Wheeler & Associates has been involved in the real estate business since 1958, with the tradition and reputation of quality appraisal work spanning over six decades. This has enabled us to maintain a solid network of real estate professionals from throughout Montana. Norman C. Wheeler & Associates is grateful for the assistance of many in the real estate community who have assisted in the confirmation of sales and market activity during the year.

Montana

Largely attributable to limited supply of desirable properties, market activity throughout Montana slowed in 2022. This trend continued as we moved through 2023, with the number of sales occurring in 2023 showing only modest declines when compared to 2022. This decrease in activity is largely attributed to low inventory of desirable properties created by the purchasing frenzy brought on by COVID era factors. As shown in the following figure, “year-to-date” sales activity in 2022 and 2023 was more reflective of sales numbers experienced in 2019, prior to the impact of COVID era factors.

While a limited supply of quality properties continued to be a common theme restricting market activity, there are no indications that demand for quality properties has subsided. This is in part reflected by the modest increase in total dollar sales volume in 2023 from 2022. While only modestly increasing from 2022 to 2023, it is important to note that total dollar sales volume in 2023 is nearly 80 percent higher than that reported in 2019. The increase in total dollar volume comes with a less than ten percent increase in the total number of sales transactions in 2023 when compared to 2019. The combination of these factors represents the rapid escalation in real estate values brought on by COVID era factors. Further, the generally stable trend in sales volume and total dollar volume between 2022 and 2023 would suggest a more stable value trend.

In general, the rural real estate market in Montana continues to be a matrix of property types that generally reflect two markets. The lower of the two are ranches that are more agriculturally oriented based on market considerations. In Montana these markets can generally be divided by regions of the State. Western Montana tends to be more recreationally influenced with high amenity properties being common. Eastern and North Central Montana largely continues to be driven by agricultural factors with lower amenity production driven properties being prevalent.

Due in large part to scenic and recreational amenities, market activity in Western Montana generally outpaces other regions of the state. Western Montana saw a notable increase in demand during COVID depleting much of the more desirable inventory in Western Montana. This caused buyers to expand their search criteria, both location and property features creating a shift in market activity throughout the state. This has largely benefited areas in Eastern Montana which experienced an increase in both the percentage sales and total dollar volume in 2023.

Statewide, the number of acres sold in 2023 was up roughly eight percent when compared to 2022. However, the magnitude and direction of this change in the number of acres sold varied greatly by region. This is demonstrated in the figure below which shows that only North Central Montana experienced an increase in acres sold in 2023.

However, the increase in acreage sold in North Central Montana is largely attributed to the sale of the IX Ranch which accounted for more than 50 percent of the acreage traded in North Central Montana during 2023. Another more notable sale was the Francis Unit of the Climbing Arrow Ranch, which accounts for nearly 40 percent of the total acreage traded in Western Montana during 2023. Absent these two sales, total acreage sold Statewide in 2023 would be roughly 22 percent below that sold in 2022.

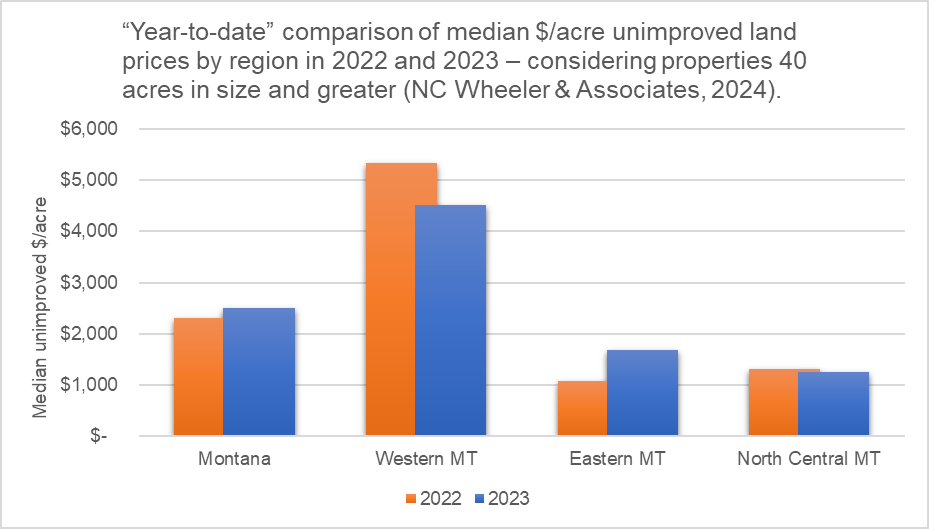

On a statewide basis median $/acre land prices show a modest increase 2023 when compared to 2022. Due in part to the broad data set, regional variation is noted and exhibited in the following graph. As shown below, analysis of “year-to-date” would suggest that Western Montana experienced a decline in median$/acre land prices. However, with many of the more desirable amenity properties trading in previous years, the decrease in median $/acre land prices shown in 2023 is thought to be a reflection of lower quality properties selling in Western Montana and not weakening demand or values. This premise is in part supported by the increase in median $/acre land prices shown in Eastern Montana, a region that has experienced an increase in demand from the recreational investor.

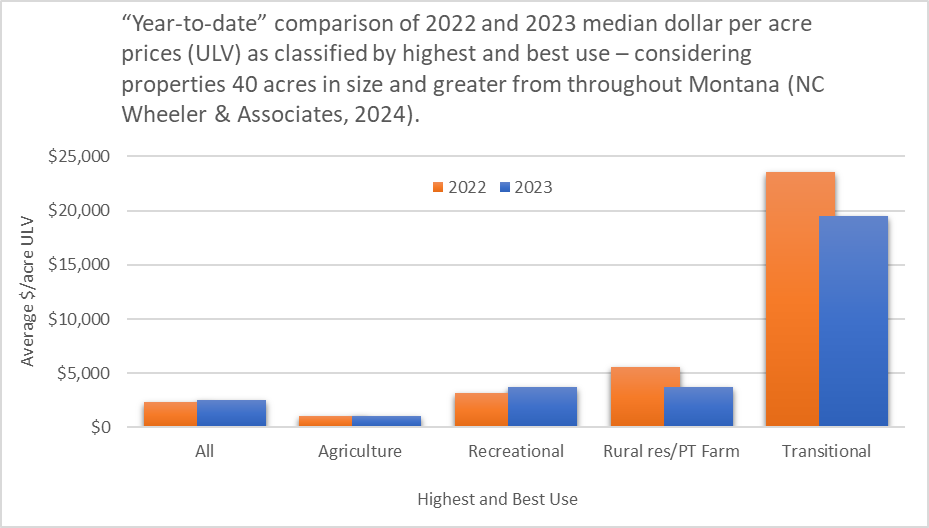

As shown in the following graph, partitioning the data by highest best use shows variation across market segment. Despite elevated interest rates, low commodity prices, and persistently high input prices agricultural land values have been surprisingly resilient. With demand remaining high and supply limited, quality recreational properties continued to sell at elevated price points in 2023. Conversely, land values in the more interest rate sensitive markets such as rural residential and transitional do appear to show some softening. It is important to note that this broad data set and that the magnitude and direction of the trends shown below can vary greatly by market area and/or region.

Outlook

As we move into 2024, we anticipate a continuation of the market dynamics experienced in 2022 and 2023. Continued geopolitical uncertainty coupled with inflationary concerns, interest rates, and election year politics all have the potential to pull investors into safe haven investments such as real estate, straining an already limited supply.

Scarce by nature, large ranch sales tend to be infrequent. Most are held in strong, multi-generational ownerships, or owned by outside investors. In either ownership scenario, the properties are not re-exposed to the market on a regular basis.

The likelihood that a significant quantity of larger more desirable properties will reenter the market is further reduced given the larger turnover in properties over the last several years. Subsequently, top tier properties located in strategic areas, along riparian corridors, adjacent to National Forests, and/or within unique ecosystems will continue to command premiums. Conversely, with the urgency to purchase a property greatly reduced, lower quality properties are anticipated to meet resistance as buyer have become more cautious. The dynamics of the current buyer pool will most likely conflict with sellers reluctant to lower purchase price as their expectations are rooted in the not-so-distant past. The combination of these factors is anticipated to create friction having the potential to limit market activity as we move forward.